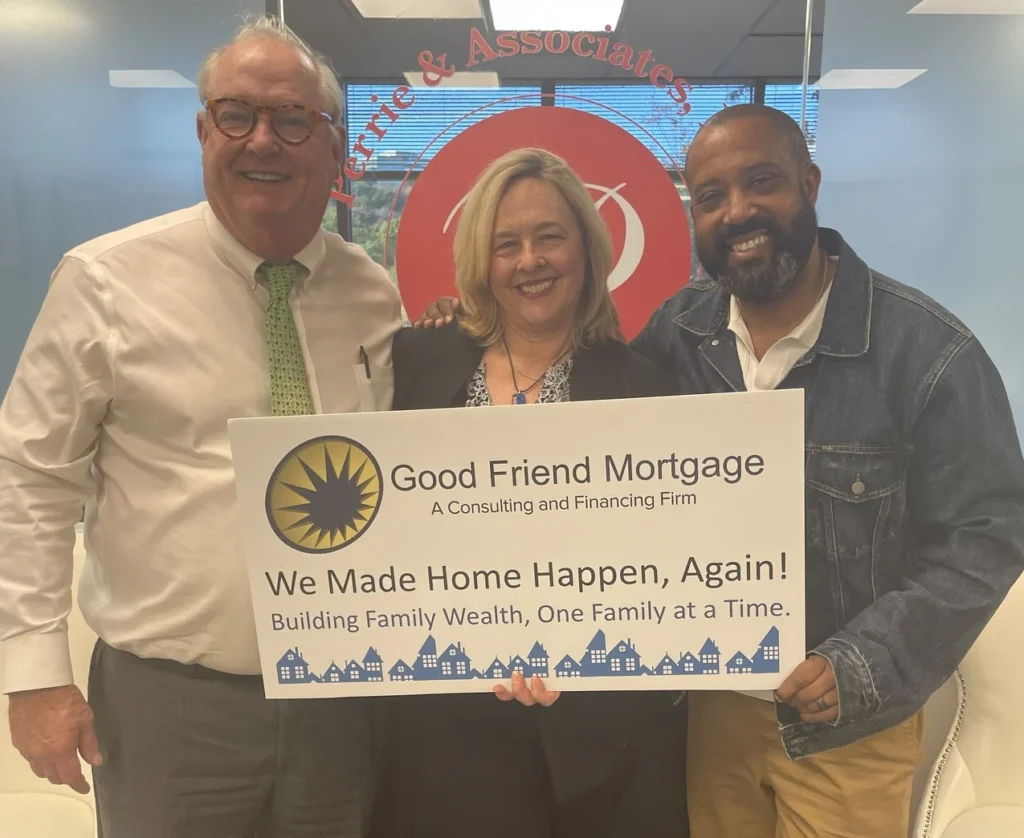

We Make Home Happen!

At Good Friend Mortgage, we specialize in guiding clients and families through the process of securing the most suitable mortgage loan for their current and future needs.

As a 5-star rated mortgage broker, we offer personalized, local access to comprehensive mortgage services and expert consulting.

Contact us today to receive the knowledgeable advice you deserve to make informed decisions about your mortgage!

Featured Mortgage Offers Today

Home Purchasing

Good Friend Mortgage has over 100 Purchase loan programs to fit the needs of our clients

Home Refinancing

Good Friend Mortgage has over 60 refinance loan programs to fit the needs of our clients

Hecm Mortgage

A Home Equity Conversion Mortgage, also called a reverse mortgage, allows borrowers to convert equity to usable cash

Mortgage Toolbox

Good Friend Mortgage provides tools to help our clients make educated decisions

Featured Mortgage Offers Today

Have questions or need assistance? Contact us for all kinds of information about mortgages

Visit our professional team member for your any help from us

A message from our CEO

At Good Friend Mortgage, we specialize in guiding clients and families through the process of securing the most suitable mortgage loan for their current and future needs.

Monthly Mortgage Payments

Happy Customers

Featured News And

Insights

Get in touch with our real estate expert

- 678-762-0127

- Loans@goodfriendmortgage.com

- 902 Abbey Ct, Alpharetta, GA 30004, United States

Fill out the form below, and we'll get back to you as soon as possible

Featured Mortgage Offers Today

Have questions or need assistance? Contact us for all kinds of information about mortgages